In today’s fast-changing financial world, creating a successful investment portfolio is not just luck. It needs a smart plan, informed choices, and the ability to adjust to market shifts. This is where investment advisory services can really help. With the help of professional financial advisors, you can create a portfolio that fits your goals, risk level, and time frame.

Choosing to work with an investment advisor can be a big step up. They have the knowledge and tools to find profitable chances you might miss1. They can guide you through different investments like stocks, real estate, and commodities. These can grow your wealth through interest, dividends, and market growth1. Plus, starting to save and invest early can help you build a lot of wealth over time, securing your financial future.

Key Takeaways

- Investing with the help of an investment advisor can unlock new wealth-building opportunities.

- Diversifying your portfolio across various asset classes can mitigate risk and maximize returns.

- Regularly rebalancing your portfolio is essential to adapt to changing market conditions.

- Leveraging the latest investment tools and technologies can enhance your portfolio management.

- Seeking professional guidance can help you navigate the complexities of portfolio management.

By using the expertise of investment advisory services, you can take control of your financial future. You can build a portfolio that grows steadily and brings you peace of mind. In the next sections, we’ll explore the power of professional investment advice, the basics of portfolio management, and strategies for reaching your financial goals.

The Power of Professional Investment Advisory

Dealing with personal finance and investments can be tough. But, a skilled investment advisor can change everything. Financial advisors offer great advice and help in managing your portfolio. They help you make smart choices and reach your financial dreams2.

Benefits of Seeking Expert Guidance

Working with a professional investment advisor brings many benefits. They share their market knowledge, plan your asset allocation, and manage risks. This helps you earn more, reduce risks, and meet your financial goals3.

Also, a top financial advisor guides you through big life changes. This includes having a child, buying a home, or planning for retirement. They make sure your investments match your changing needs3.

How to Choose the Right Investment Advisor

Finding the right investment advisor is key for good portfolio management. Look at their qualifications, experience, fee structure, and if they act as a fiduciary. Make sure their investment style fits your financial goals and how much risk you can take3.

With a reliable financial advisor, you get their knowledge, peace of mind, and make better choices. This secures your financial future3.

“A good financial advisor can help you prioritize financial goals and craft a personalized financial strategy to achieve them.”3

Understanding Portfolio Management

Portfolio management is key to successful investing. It involves choosing the right mix of assets to get good returns and avoid risks. This process includes setting financial goals, understanding risk levels, and managing investments4.

Definition and Scope of Portfolio Management

Portfolio management is about making smart choices about investments. It matches investments with goals and balances risk and performance. It’s about managing a group of investments to meet financial goals4.

Portfolio managers make money from selling financial securities. They usually earn 3-4% from commissions4.

Objectives of Portfolio Management

The main goals of portfolio management are to get good returns, avoid risks, and keep money liquid. It aims to balance income and growth. This is done by picking the right investments based on goals and risk tolerance4.

Investment advisors charge different fees. They can get paid a flat fee, by the hour, or based on the assets they manage. Their fees usually range from 0.50% to 2% per year4.

| Key Metrics | Definition | Significance |

|---|---|---|

| Alpha | Outperformance of a benchmark by a certain percentage | An alpha of 1% signifies outperformance of the benchmark by 1%5. |

| Beta | Measure of an investment’s volatility relative to the market | A beta of 1 indicates that an investment moves in line with the market, while a beta above 1 hints at greater volatility5. |

| Sharpe Ratio | Risk-adjusted return, calculated as excess return divided by standard deviation | The Sharpe ratio showcases the degree of return an investor receives for the volatility of holding an asset5. |

Portfolio managers can earn a percentage of commission on products sold. In a fee-only model, they don’t charge fees but earn from commissions4. Investment advisors must act in the client’s best interest and earn based on client growth4.

In a commission-based model, advice might be biased. This is because advisors earn from selling products4. Portfolio managers focus on investment advice, while advisors offer broader financial advice4.

Components of a Successful Portfolio

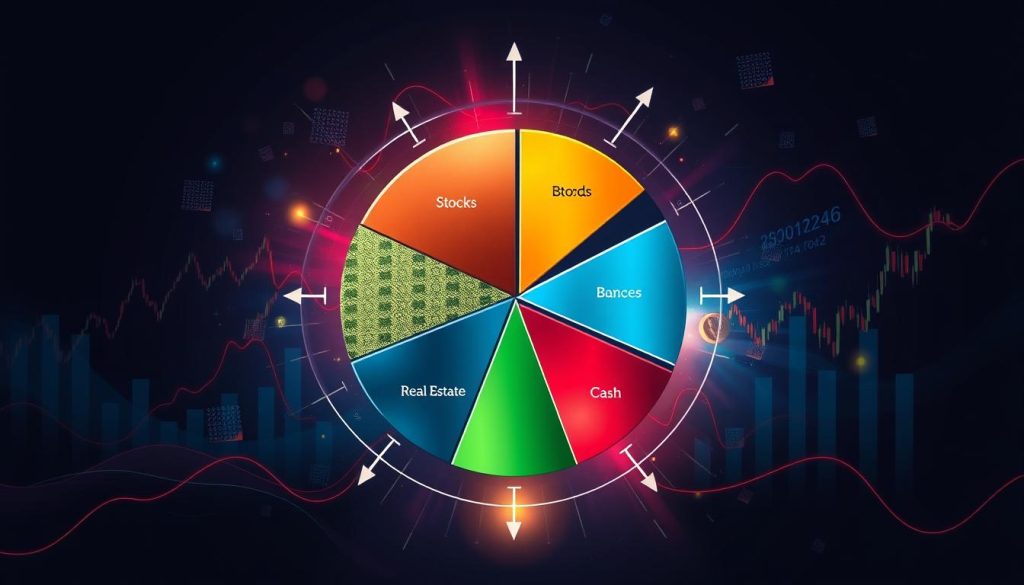

Asset allocation is key to a strong investment portfolio. It can make up to 90% of your returns over time6. Spreading your investments across different types, like stocks and bonds, helps manage risk and boost returns.

Asset Allocation Strategies

Your asset allocation strategy should match your goals and risk comfort. A balanced portfolio mixes stocks, bonds, and cash for steady growth and income. An aggressive portfolio focuses on stocks for higher returns but with more risk. A conservative portfolio, on the other hand, prioritizes bonds for stability.

Investing globally is important for diversification. It can lower risk and increase potential returns6. But, many investors tend to stick to their home market, missing out on global opportunities6.

It’s also vital to avoid putting too much in one stock. This can lead to big losses6. Companies like Enron and Lehman Brothers have failed, showing the need to check a company’s health before investing6. A diversified portfolio can protect against such losses6.

| Portfolio Type | Risk Tolerance | Investment Mix | Potential Returns |

|---|---|---|---|

| Conservative | Low | Bonds, Cash | Lower |

| Balanced | Moderate | Stocks, Bonds, Cash | Moderate |

| Aggressive | High | Stocks | Higher |

Creating a personalized portfolio on Streetbeat costs $69 a year or $9 a month7. You can choose from stocks, bonds, gold, real estate, and cryptocurrencies to fit your risk level and goals7.

A successful portfolio is one that fits your needs, with a mix of assets to manage risk and increase returns over time.

investment advisory Strategies

Working with an experienced investment advisor can change the game for your finances. They use different strategies to build a winning portfolio. These include growth investing, value investing, and income investing. Each strategy has its own way of working and benefits.

Investment advisors often use growth investing. This strategy looks for companies with fast growth. They focus on new or changing industries8. Growth investors aim for big gains over time.

Value investing is about finding stocks that are cheaper than they should be9. Advisors look at a company’s finances and more to find these hidden gems. They want to find stocks that will make money as their value is recognized.

Income investing is another strategy10. It focuses on making regular money from things like bonds and stocks that pay dividends. This strategy is good for those who want a steady income.

Knowing about these strategies helps you and your advisor create a portfolio that fits your goals. With their help, you can tackle the financial markets and aim for your investment goals.

“The secret of getting ahead is getting started. The secret of getting started is breaking your complex overwhelming tasks into small manageable tasks, and then starting on the first one.” – Mark Twain

Risk Management and Diversification

Effective risk management is key to a successful portfolio. It involves identifying and managing risks to protect your investments. This includes diversification, hedging, and using financial derivatives to handle market volatility. By managing investment risk well, you can keep your portfolio safe from big losses and handle market ups and downs.

Importance of Risk Management

Diversification is a major risk management tool. It means spreading your investments across different asset classes like stocks, bonds, and cash11. Choosing quality investments over quantity is important to avoid average returns11. A well-diversified portfolio can lower the risk of big losses by spreading investments11.

Diversifying across different asset categories helps protect against market volatility. It also increases the chance of reaching your long-term financial goals11.

Diversification: Key to Mitigating Risk

Diversification is a basic strategy for managing portfolio risk. By investing in different sectors, industries, and regions, your portfolio becomes more resilient11. It’s important to understand how different investments relate to each other for effective diversification11.

Creating a diversified portfolio involves mixing different investment types in the right amounts. This reduces volatility and can improve returns11. A good portfolio should include equities, fixed income, and alternatives like real estate. But, it’s best to diversify even more for the best risk management11.

Within equities and fixed income, diversifying further is important. This includes diversifying within subcategories like large U.S. growth stocks and long-term bonds11. In today’s world, diversification is essential for most investment portfolios11. A successful diversification strategy needs a long-term view and avoids market timing11.

“Diversification is the only free lunch in investing.”

By using good risk management and diversification, you can protect your investments. This increases the chance of reaching your long-term financial goals.

Tools and Technologies for Portfolio Management

In the fast-changing world of investment, new tools are making a big difference. Portfolio management software, analytical tools, and mobile apps are changing how we manage investments. They help make decisions easier, track performance better, and are super easy to use12.

The Bloomberg Terminal is a top choice for portfolio management software. It gives users real-time financial data and insights. This helps them make smart choices based on current market trends12. Other AI tools like Alphasense, Sentieo, and QuantConnect also offer advanced features for analysis and risk assessment12.

Mobile apps add convenience to portfolio management. Apps from Empower Advisory Group, SigFig, and Kubera let investors check their portfolios anytime. They work well with portfolio management software for a smooth experience13.

| Portfolio Management Tool | Founded | Asset Classes Tracked |

|---|---|---|

| Quicken Premier | 198213 | Stocks, mutual funds, options, bonds, ETFs, physical/tangible assets, real estate13 |

| Sharesight | 200813 | Stocks, mutual funds, ETFs, term bonds, deposits, cryptocurrency, forex, options, private equity, real estate, precious metals13 |

| Empower Advisory Group | 200613 | Stocks, bonds, funds, cash alternatives, real estate13 |

| SigFig | 200713 | U.S.-based stocks, U.S.-based bonds, developed (non-U.S.) and emerging market stocks, real estate, short-term U.S. Treasury securities13 |

| Kubera | 201913 | Stocks, ETFs, mutual funds, cryptocurrency/DeFi, NFTs, real estate, cars, metals, web domains, cash, private investments13 |

Using portfolio management software, analytical tools, and mobile applications helps investors and advisors a lot. They can manage investments better, make smart choices, and keep up with market changes12. These tools are changing the investment world, helping both individuals and professionals manage their portfolios well.

Conclusion

Successful portfolio management needs a smart plan, good decisions, and flexibility with market changes. Knowing the basics of portfolio management helps. This includes how to spread out investments, manage risks, and work with investment advisors. This way, investors can make a portfolio that fits their financial goals and how much risk they can take14.

The cost for investment advisors varies, from 1% to 2% of what they manage. In 2019, RIAs charged about 1.17% on average, a bit less than the year before14. To be an RIA, one must pass a big exam and set fees in different ways. This can be a flat fee, tiered fees, or a percentage of what clients have invested14.

The field is changing, and investment advisory firms are improving their offers. They are mixing young and experienced advisors and using new tech to keep clients15. By keeping up with these changes and offering full financial planning advice, advisors can be key partners. They help clients reach their financial goals and deal with today’s portfolio management challenges15.

FAQ

What are the key principles of successful portfolio management?

How can professional investment advisory services benefit investors?

What factors should investors consider when choosing an investment advisor?

What is the definition and scope of portfolio management?

What are the primary objectives of portfolio management?

What are the different asset allocation strategies?

What are the key investment strategies that advisors may employ?

Why is effective risk management crucial in portfolio management?

How does diversification help in portfolio management?

What tools and technologies are available for effective portfolio management?

Source Links

- Investment Management: Making the Most of Your Money with an Investment Advisor | BartleyFinancial

- Investments & Wealth Institute │ Financial Advisor Certification

- What Does a Financial Advisor Do and Should I Get One?

- Portfolio Managers vs. Investment Advisors: How Do the Two Differ? – WiserAdvisor – Blog

- Portfolio Management: Definition, Types, and Strategies

- 9 Crucial Components of an Investment Portfolio Review

- What Is A Portfolio?

- Investment Advisers

- What Is an Investment Adviser, How Do They Work?

- Investment Advisory Program: Personalized Investment Advice

- Why Is Diversification Important | First Financial Consulting

- 10 AI Tools for Portfolio Management and Financial Advisory

- Best Portfolio Management Software Tools 2024

- What is an Investment Advisory?

- 4 Conclusions on What It Takes to Be a Successful Next Generation Financial Advisor