Modern life is complex, and securing your family’s financial future is key. Term life insurance is a smart, affordable choice. It offers reliable protection and peace of mind. Unlike permanent policies, term life gives a tax-free death benefit to your loved ones if you pass away during the policy term.

This benefit helps cover expenses like mortgages, debts, and child-rearing. Term life insurance has lower premiums than whole or universal life insurance. This makes it easier for families to get the coverage they need.

For example, a 30-year-old non-smoking man or a 30-year-old healthy woman can get a $500,000, 30-year policy for about $30 and $25 per month, respectively. This shows that term life insurance can be surprisingly affordable.

Key Takeaways

- Term life insurance provides affordable, reliable financial protection for a set period of time.

- The death benefit can help cover essential expenses like mortgages, debts, and child-rearing costs.

- Premiums are significantly lower than permanent life insurance options, making it more accessible.

- Coverage levels of $100,000, $250,000, $500,000, and $1,000,000 are commonly offered at competitive rates.

- Understanding the factors that affect your term life insurance premiums is crucial in finding the right policy.

What is Term Life Insurance?

Term life insurance offers coverage for a set time, called the “policy term.” It doesn’t grow a cash value like permanent life insurance. Instead, it pays a death benefit to your loved ones if you pass away during the term.

Understanding Term Life Insurance Policies

Term life insurance policies last from 10 to 30 years. They cost less than permanent life insurance. This makes them a budget-friendly choice for many.

Term life insurance is flexible. Some policies offer extra benefits, like money for a terminal illness or disability benefits if you can’t work. When picking a policy, think about your financial needs, budget, and any tax benefits.

| Key Differences: Term vs Permanent Life Insurance | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Period | Temporary (10-30 years) | Lifelong |

| Cash Value Accumulation | No | Yes |

| Premiums | Generally lower | Generally higher |

| Flexibility | More flexible (can be renewed or converted) | Less flexible |

Knowing the differences between term and permanent life insurance helps you choose the right coverage for your needs and budget.

Key Benefits of Term Life Insurance

Term life insurance is a great way to protect your family’s financial future. It offers a death benefit that gives your loved ones financial security if you pass away. This tax-free payment can help with things like mortgages, debts, and raising kids, keeping your family stable even without you.

Another big plus is how affordable term life insurance is. It costs much less than permanent life insurance, making it easier for people with tighter budgets to get coverage. This means you can get a big death benefit without spending a lot.

Term life insurance also lets you customize your coverage. You can pick how long you want the policy to last, from 10 to 30 years. And you can change how much coverage you have as your life changes. Plus, many policies come with extra benefits, like getting money early if you’re very sick or help with paying premiums if you get disabled.

| Benefit | Description |

|---|---|

| Death Benefit | The tax-free payment provided to your beneficiaries in the event of your passing, ensuring financial security for your loved ones. |

| Affordability | Term life insurance premiums are significantly lower than those of permanent life insurance, making it a budget-friendly option. |

| Coverage Flexibility | You can choose the policy term length and adjust the coverage amount to meet your changing needs over time. |

| Policy Riders | Many term life policies offer additional benefits, such as early access to funds for terminal illness or assistance with premium payments if you become disabled. |

Getting a term life insurance policy means you’re giving your family the financial safety they need. It helps ensure their well-being, even when unexpected things happen.

term life insurance

Term life insurance is a great choice for families today. It offers coverage lengths from 10 to 30 years and death benefits from $250,000 to $10 million. This meets many needs and budgets.

People aged 18 and up who are U.S. citizens or permanent residents can get term life insurance. The underwriting process is key. Insurers look at your age, health, lifestyle, and job to set your premium costs. Young, healthy people with safe jobs pay less than older or sicker individuals.

- Term life insurance policies offer coverage lengths from 10 to 30 years

- Death benefits range from $250,000 to $10 million

- Eligibility is open to U.S. citizens and permanent residents aged 18 and above

- Underwriting process evaluates age, health, lifestyle, and occupation to determine premiums

- Younger, healthier individuals with low-risk profiles pay lower premiums

Term life insurance is flexible, with various coverage lengths and death benefits. It’s designed to protect your family’s financial future. Knowing the eligibility and underwriting process helps you find the best policy for your needs and budget.

“Term life insurance is the simplest and most affordable way to protect your family’s financial future.”

Determining Your Term Life Insurance Needs

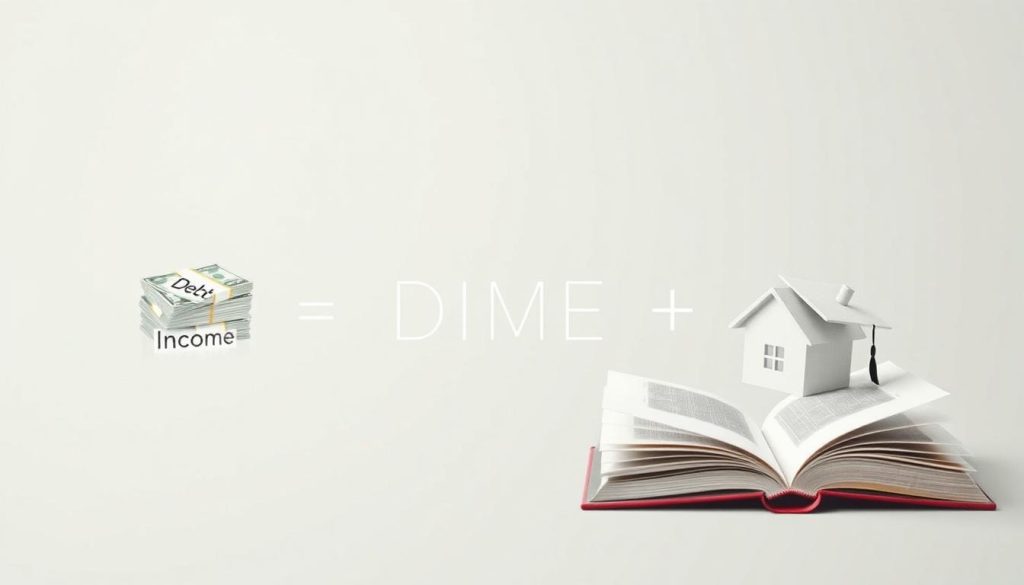

Finding the right term life insurance for your family is crucial. The DIME formula helps figure out how much coverage you need. It looks at your debts, income, mortgage, and your kids’ education costs.

Another way is to think about replacing your income and adding a little extra. Experts say to get at least 10 times your annual income in coverage. This ensures your family’s financial safety if you’re not there.

Calculating Your Coverage Amount

Don’t forget the value of a stay-at-home parent’s work. Even without a traditional job, your care and household management are priceless. Life insurance calculators can guide you to the right coverage amount.

The “DIME” method is a good starting point. It covers debts, education, and income until your kids are 18. Or, you can use the “Standard-of-Living” method. This method multiplies your needed standard-of-living by 20 or 15, depending on your age.

Factoring in Family Responsibilities

Talking openly about your family’s financial goals is key. Think about big life events like buying a house or having a child. Tailoring your coverage to your needs ensures your family’s financial security.

The aim is to keep your family’s lifestyle going, not just spend the money. By carefully looking at your needs, you can find the right term life insurance for your family.

Conclusion

Securing your family’s financial future is crucial. By investing in term life insurance, you protect your loved ones. It’s a key step towards giving them the coverage they need.

Term life insurance is affordable and flexible. It’s perfect for any stage of life, whether you’re starting a family or planning for retirement. It offers peace of mind for you and your family.

Understanding term life insurance’s benefits is important. It’s cost-effective and can be tailored to fit your needs. With various coverage options, you can find a policy that meets your family’s needs and goals.

When buying term life insurance, consider your age and health. The younger and healthier you are, the lower your premiums. With the right policy, your family’s financial security is ensured. You can then focus on the important moments in life.

Invest in term life insurance today. Give your loved ones the gift of financial protection for the future.

FAQ

What is term life insurance?

How does term life insurance differ from permanent life insurance?

What are the primary benefits of term life insurance?

How do insurers determine term life insurance premiums?

How do I determine the right amount of term life insurance coverage?

Why is purchasing term life insurance a smart decision for modern families?

Source Links

- Term Life Insurance Demystified: Why It’s the Smartest Decision for Modern Families

- 5 Different Types of Life Insurance & How to Choose in 2024 – NerdWallet

- Term vs. Permanent Life Insurance

- What Is a Term Life Insurance Policy?

- Term Life Insurance: What It Is, Different Types, Pros and Cons

- The Benefits of Term Life Insurance (2024)

- Aflac Supplemental Insurance

- Term life insurance | Financial resources & coverage options | Fidelity

- Term Life Insurance – Get A Quote

- How Much Life Insurance Should You Have?

- How Much Life Insurance Do I Need? – NerdWallet

- Term Life vs. Whole Life Insurance: Key Differences and How To Choose – NerdWallet

- Term vs. Whole Life Insurance: What’s the Difference?

- 4 Advantages of Term Life Insurance – NerdWallet